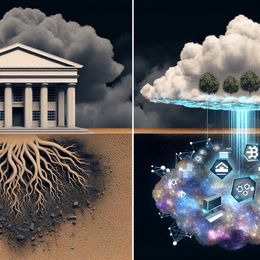

Welcome to the cutting-edge world of cloud computing, where traditional banking is being revitalized through digital metamorphosis. Santander Bank’s ambitious journey to migrate its corporate investment banking business to the cloud is not just a testament to innovation but a beacon that illuminates the path forward for the financial industry. This transformation is part of a comprehensive strategy to shift all operations onto a cloud platform, which is redefining efficiency, security, and customer service standards. In this blog post, we embark on an inspirational voyage through Santander Bank’s cloud transition, exploring how the venerable $1.9 trillion Madrid-based bank leverages Google Cloud’s platform to launch Gravity, its cloud-native digital banking platform, and how it plans to elevate its operations in the forthcoming year. Let’s unfold the narrative of how Santander Bank is rocketing towards a new banking horizon through cloud technology.

Seeding the Cloud: The Inception of Gravity

The seed of change was planted when Santander recognized the immense potential that cloud technology held for the future of banking. This foresight led to the birth of Gravity, a platform designed to be cloud-native from the ground up. Leveraging the robust infrastructure and advanced capabilities of Google Cloud, Santander laid the foundation for a system that promised scalability, flexibility, and agility.

Adopting the cloud meant crafting a platform that was not only technologically superior but also culturally transformative. It required the bank’s workforce to embrace the cloud’s potential, redefining their roles within the ecosystem of financial services. As they witnessed their traditional tools and methodologies evolve, Santander’s team underwent re-skilling to become proficient navigators of this new digital landscape.

The Puzzle of Migration: Navigating Complex Operations

Transferring Santander’s corporate investment banking to the cloud was akin to assembling a multifaceted puzzle. The complexity of existing operations, coupled with regulatory compliance and data security, presented a labyrinth that demanded meticulous planning and execution. Transitioning to Gravity required a holistic approach, ensuring that every piece of legacy data and every transaction found its rightful place within the new system.

During this phase, it was critical to maintain uninterrupted services for clients while simultaneously orchestrating the behind-the-scenes engineering ballet. This balancing act was made possible by parallel running systems, thorough testing procedures, and contingency planning, guaranteeing a seamless customer experience throughout the transition period.

With its roots now firmly in the cloud, Gravity stood as the digital backbone of Santander’s corporate investment banking business. The platform’s cloud-native capabilities ensured that it could handle complex financial products, high-volume transactions, and intricate analytical tasks with ease. Enhanced computational power, automated workflows, and real-time data analytics repositioned Gravity not just as a platform but as a strategic asset that empowered Santander to make informed, data-driven decisions.

The agility of the cloud environment also promulgated a new wave of product innovation. Santander was no longer tethered to the limitations of physical infrastructure. Instead, it could rapidly deploy updates, develop cutting-edge financial instruments, and enhance user experiences, staying ahead of the curve in a highly competitive environment.

Cloud Cover: Fortifying Security and Regulatory Compliance

Security is paramount in the banking sector, and transitioning to the cloud raised the specter of new challenges. Yet, Santander’s approach to cloud adoption put a premium on building a fortress of digital security. By instituting rigorous protocols and leveraging advanced encryption technologies, Gravity ensured the sanctity of sensitive financial data.

Regulatory compliance, much like security, was non-negotiable. The Gravity platform was engineered to align with the stringent financial regulations and industry standards. Continuous auditing mechanisms and compliance tracking tools were integrated into the platform, providing Santander with a thoroughfare for maintaining impeccable compliance records.

Connectivity and Collaboration: The Ecosystem Approach

In the cloud era, a bank is as much a part of a technological ecosystem as it is a financial institution. Santander’s move to the cloud facilitated unrivaled connectivity and collaboration with fintech companies, data providers, and other financial institutions. The bank could now partake in and contribute to a shared digital economy that transcended traditional boundaries.

Gravity’s cloud-native framework meant that Santander could interface with APIs from a myriad of service providers, harnessing expertise and capabilities beyond its own walls to deliver comprehensive solutions to its clients. This cooperation within the digital ecosystem raised the bar for what customers could expect from their banking partners.

Wisdom in the Clouds: Extracting Lessons from Santander’s Journey

There are rich lessons to be gleaned from Santander’s cloud migration – lessons of vision, strategy, and execution. The bank’s confidence in deploying a cloud-native platform underlines the importance of building for the future, even when the present is not fully equipped to comprehend its magnitude. Santander’s unyielding focus on security and compliance underscores the need to never compromise on the bedrock principles of banking, even when navigating the frontiers of technology.

The Gravity initiative is a beacon for those daring to reimagine the financial landscape. It stands as proof that with the right mixture of courage, innovation, and collaboration, even the most established industries can be thoroughly transformed.Are you ready to join the movement and redefine the scope of what’s possible within your organization? Connect with me on [LinkedIn](https://www.linkedin.com/in/laurentrochetta/) to explore how you can harness the powerful wave of cloud technology and embark on a journey of unparalleled progress and innovation. Santander’s expedition to the cloud is but a glimpse into the future of banking – a future where boundaries are continually pushed, and the impossible is made possible. 🌐💡🚀