The Dawn of a New Era: Spot Bitcoin ETFs Set to Go Live

The world of finance stands on the brink of revolution as Spot Bitcoin Exchange-Traded Funds (ETFs) prepare to enter the trading arena, a move setting the stage for a significant pivot in cryptocurrency engagement amongst mainstream investors. With rumors of an approval as imminent as this Wednesday, the subsequent live trading could commence by week’s end, according to industry insiders who spoke with CNBC. The Catalyst for Mainstream Bitcoin Adoption The potential inception of Spot Bitcoin ETFs goes beyond the confines of a typical financial product launch; it marks an evolutionary step in investment portfolios. For the unacquainted, these ETFs promise a novel path, one that facilitates direct investment in Bitcoin without the complexities of managing digital wallets or navigating the convoluted terrain of cryptocurrency exchanges. The prospective approval by regulatory authorities underscores the growing institutional confidence in Bitcoin’s place within the tapestry of traditional investment options. As mainstream access to Bitcoin broadens, the narrative of cryptocurrency as a niche market is being rewritten, changing the way traditionalists view and interact with digital assets. A Paradigmatic Shift in the Financial Ecosystem The buzz surrounding Spot Bitcoin ETFs is hardly coincidental. Beyond a mere investment vehicle, these funds encapsulate a broader movement toward blockchain technology and its disruptive potential. With the green light from regulators, Bitcoin ETFs are poised to unlock a trove of possibilities for investors seeking to navigate the financial shifts shaped by digital currencies. This leap isn’t just technical, it’s profoundly symbolic; a testament to a decade of innovation, resilience, and community efforts to legitimize cryptocurrencies. The seal of approval on such products would echo through the halls of finance, signaling a welcomed merger between innovation and legacy financial frameworks. Bridging Currencies, Cultures, and Continents Critical in this equation is the democratization of Bitcoin investment. A Spot Bitcoin ETF represents a bridge, joining variegated interests from individuals with varying degrees of technological acumen. It’s a tool of inclusivity, a beacon drawing a diverse range of investors, and connecting the dots between currencies, cultures, and continents. Institutions like ARK Invest, led by the indomitable Cathie Wood, and partnerships like ARK’s with 21Shares, aren’t just participating in the market – they’re pioneering a blueprint for the future of investment modality. Their leadership further legitimizes the foray into this uncharted territory. Examining the Market Pulse Anticipation resonates throughout the investor community, with eyes fixated on the calendar, counting down to the pivotal announcement. The introduction of Spot Bitcoin ETFs is viewed as a bellwether for Bitcoin’s adoption – a sentiment meter that gauges the market’s readiness for embedding cryptocurrencies into its fabric. Yet, as with all epochal changes, uncertainty persists. The exact timing of the launch, the market reactions, and the subsequent integration challenges are points of speculation. What remains unequivocal is the market’s hunger for innovation and its readiness to embrace Bitcoin through these ETFs. The Ripple Effect on Global Finance The inception of Spot Bitcoin ETFs isn’t an isolated event; it’s a ripple creating waves across the spectrum of global finance. This momentous stride in Bitcoin integration reflects a seismic shift not just in investor perception but a new financial ethos where digital currencies are a cornerstone. The wider implications are vast, with possible effects on currency valuations, international trade dynamics, and even monetary policy considerations. This isn’t simply about Bitcoin; it’s an inflection point that may redefine the way nations and businesses interact economically. The Final Piece: Regulatory Endorsement At the crux of this narrative is regulatory endorsement. The transition to live trading Spot Bitcoin ETFs encapsulates a long sequence of rigorous evaluations, debates, and painstaking diligence by financial watchdogs. This last piece of the puzzle is critical, ensuring that the introduction of such ETFs occurs within a framework of trust, security, and regulatory compliance. While the market awaits confirmation with bated breath, the implications of such a seal of approval ripple through the industry. It is a nod to technological advancement and market evolution, and the long-awaited handshake between tradition and modernity.Are you ready to join the movement and redefine the scope of what’s possible within your organization? Connect with me on [LinkedIn](https://www.linkedin.com/in/laurentrochetta/) to explore how innovative breakthroughs in Bitcoin ETFs can enhance your financial strategy and position you at the forefront of this transformative era in finance. 🚀🌟

Transformative Tech Tide: BNY Mellon’s Bold Digital Odyssey

Imagine living in a world where technology is much more than a mere tool; it is a consistent source of income. The world is already witnessing such a change, with digital businesses controlling the realms of finance and offering innovative solutions to complex problems. So, the question here is, can these digital banking businesses serve as a persistent revenue source? Can an institution like BNY Mellon develop a tech-driven operation that carves out a significant slice of the financial industry? This blog post sheds light on these questions and offers an inspiring roadmap for aspiring digital bankers. The Digital Groundwork: BNY Mellon’s Technological Investment In the fast-paced world of finance, BNY Mellon has boldly earmarked a staggering 30% of its noninterest expenses for technology. This move is not just about keeping up with the Joneses – it’s a visionary stride into the digital future. The decision to allocate $3.8 billion towards tech speaks volumes about the bank’s commitment to innovation. Year after year, technology has swept across the banking landscape, redefining consumer expectations and operational efficiency. However, the road to tech integration is paved with challenges and requires a meticulous strategy to overcome legacy systems and adopt cutting-edge solutions. With the investment, BNY Mellon isn’t just dabbling in digitalization; it’s executing a deep-rooted transformation. This colossal financial infusion aims to harness technology’s prowess, from artificial intelligence and blockchain to cloud services and cybersecurity enhancements. By betting big on tech, BNY Mellon aspires to rise as a formidable force in the banking world, where technological supremacy dictates market leadership. The Strategy Canvas: Behind BNY Mellon’s Spending Splurge Technology spending isn’t mere extravagance. It’s a calculated tactic to secure a competitive edge. In BNY Mellon’s case, investing $3.8 billion in tech represents a tactical move to carve out a new operational blueprint, emphasizing agility, customer service, and innovation. Analyzing the bank’s tech spend reveals a multi-faceted approach addressing areas like automated banking processes, enhanced data analytics capabilities, and the creation of personalized customer experiences. Diving deeper, we find the bank’s endeavor to reshape its infrastructure, boasting a robust digital platform that can weather the evolving demands and security threats of our time. This sizable financial commitment underscores BNY Mellon’s strategy to sustain growth, safeguard assets, and streamline services, positioning itself at the apex of the digital banking revolution. Tech-First Culture: Cultivating Innovation Within BNY Mellon’s tech-focus heralds more than just new tools; it encapsulates a mindset shift, fostering a tech-first culture across its global enterprise. By embedding technology into the DNA of operations, the bank pledges allegiance to continuous improvement and radical innovation. The internal culture is being tweaked to encourage out-of-the-box thinking, risk-taking, and collaborative creation, fuelling a consistent drive towards market differentiation and leadership. Employees at every level are now armed with the digital empowerment necessary to excel in their roles, leading to improved decision-making, enhanced productivity, and an enduring commitment to excellence. The ripple effect of this tech-first culture is boundless, touching every corner of the organization and unlocking potential in unforeseen areas. The Beacon of Innovation: BNY Mellon’s Digital Service Revolution In an arena where digital disruption is the norm, BNY Mellon’s lavish tech spend mirrors a pursuit to lead the digital service revolution. This isn’t just about staying relevant; it’s about defining the future of banking services. From blockchain-driven transaction systems to AI-powered risk assessment, the bank is meticulously crafting a suite of services that promises unparalleled efficiency and security. The vision is crystal clear: establish BNY Mellon as an innovation lab of sorts, where novel fintech solutions are not just incubated but also seamlessly integrated into the client experience. This strategy transcends traditional banking, offering customers an avant-garde portal to their financial needs, underscored by reliability and trust. Customer Centricity: Redesigning the BNY Mellon Experience BNY Mellon’s technology investments are all-encompassing, directly impacting customer interaction by reshaping the user experience. The digital transformation journey is about delivering custom-tailored solutions and streamlining processes to enhance client satisfaction. This emphasis on customer centricity drives a redesign of the BNY Mellon experience, ensuring that every client interaction is intuitive, engaging, and solution-oriented. This quest for customer excellence is redefining the notion of banking convenience, with a strong focus on omni-channel service delivery and real-time customer support. By centering technology around the client, BNY Mellon is en route to setting a new standard in customer relations, one that other banks will vie to emulate. Embracing Change: The Future of BNY Mellon’s Tech Initiative With the foundations now firmly set, BNY Mellon’s ambitious technology spending is a testament to its resolute embrace of change. As digital trends evolve and new technologies emerge, the bank’s adaptability will be its linchpin, ensuring that it stays ahead of the curve. Looking to the future, BNY Mellon is expected to continue ramping up its innovations, focusing on sustainable growth and the integration of green technology, further embedding it into the fabric of financial service excellence. The financial realm that BNY Mellon is crafting is one of perpetual evolution, where technology isn’t just a budget line item but the cornerstone of corporate identity and customer value proposition. The future is digital, and BNY Mellon is setting sails to navigate this uncharted territory with confidence and prowess.Are you ready to join the movement and redefine the scope of what’s possible within your organization? Connect with me on [LinkedIn] to explore how you can harness the power of transformative technology and embark on a journey of unparalleled productivity. 🚀🌟

The Shockwaves of Intimidation: eBay’s Harrowing Saga & The Heavy Cost of Corporate Misconduct

Imagine opening your business news feed to a headline that seems straight out of a thriller – except, it’s not fiction, but a disturbing reality of corporate intimidation. This setting relates to the once-inconceivable notion that reputable employees of a tech giant, eBay, would engage in a menacing campaign against a humble Massachusetts couple, simply for their work in producing an e-commerce newsletter that occasionally critiqued the company. This blog post delves deep into how a desire to silence critics led to a vendetta culminating in eBay admitting guilt and a hefty financial penalty. Join us as we uncover the layers of this corporate scandal and extract salient lessons for the business world. Unveiling The Scandal: An Introduction to eBay’s Intimidation Case The scandal first came to light when a series of disturbing deliveries and anonymous threats began targeting a couple in Natick, Massachusetts. What was their crime? Exercising free speech through their newsletter about e-commerce companies, including critical views on eBay’s practices and policies. eBay’s internal leadership at the time took the critiques as a personal affront, galvanizing a group of employees to embark on an intimidation campaign aimed at silencing these dissonant voices. The Response: Law Enforcement Steps In The situation escalated as law enforcement traced the harassment back to eBay employees. Investigations unearthed a sinister and premeditated plot that involved stalking, cyberbullying, and sending disturbing parcels to instill fear. The investigators uncovered a deeply troubling side of corporate culture—one that could stoop to vindictive actions to protect its reputation. The Crackdown: Consequences for Corporate Malfeasance The actions of eBay’s employees were not just shameful but also illegal. The federal investigation concluded with eBay taking accountability for their employees’ actions by agreeing to pay a $3 million criminal penalty. This sum, though substantial, is a mere financial indicator of the much larger ethical and reputational cost paid by the company. The Underlying Issues: A Look at Corporate Ethics The eBay intimidation case brings into focus the critical need for strong ethical frameworks within corporates. It begs us to question the nature of workplace cultures that may implicitly endorse overzealous protectionism or allow vindictiveness to fester amongst its ranks. A company’s code of conduct must unequivocally emphasize respect for the rule of law and freedom of speech. The Future Outlook: Corporate Morality in the Spotlight The e-commerce universe and the corporate world at large will be scrutinizing eBay’s next steps. Will this case serve as a turning point, heralding a new era where companies place equal emphasis on ethical conduct as they do on market dominance? Only time will tell, but the precedence set here will reverberate across boardrooms everywhere. Conclusion: Charting a Course for Ethical Integrity The eBay saga is more than a tale of intimidation; it’s about the vital essence of corporate conscience in today’s world. A company can only thrive sustainably when it aligns its strategies with the fundamental principles of fairness, legality, and moral rectitude. As we reflect on this story’s implications, let it not just be a narrative of wrongdoing but a catalyst for holistic improvement in corporate behavior. After all, the true success of any enterprise lies not merely in its financial statements but in its ethical scorecard.Are you ready to engage in meaningful dialogue about corporate ethics, technology governance, and the road to redemption for businesses that stray from their moral compass? Connect with me on [LinkedIn](https://www.linkedin.com/in/laurentrochetta/) to explore these pressing issues further and ensure your organization’s journey is paved with integrity. 🚀🌟

🚀 On the Brink of a Revolution: The Inevitable Approval of Bitcoin ETFs 🌟

The financial globe is perched on the precipice of groundbreaking change; the relentless drumbeat of anticipation within the Bitcoin ethos resonates with the certainty of a Spot Bitcoin Exchange-Traded Fund (ETF) coming to fruition. Astonishingly candid, Jay Clayton, former chair of the U.S. Securities and Exchange Commission (SEC), has vocalized a bold assertion during a CNBC interview. His words resound with conviction: the approval of a Spot Bitcoin ETF is not a matter of if but when, as “there’s nothing left to decide.” The shimmering prospect of an approved Spot Bitcoin ETF not only electrifies Bitcoin proponents but also signifies a seismic shift in the regulatory stance towards crypto-financial products. Clayton’s assertive stance echoes within the chambers of the Bitcoin community—a community fervidly poised on the verge of triumph. 🌐 The Dawning of a New Era in Finance In the depth of Clayton’s insight lies an acknowledgment of progression: the infrastructure underpinning Bitcoin—once challenged for robustness and efficacy—is today stoutly fortified. A veritable engine of reliability, it has evolved leagues beyond its former self from five years past. This remarkable evolution lends credence to the trustworthiness of the Bitcoin market as a foundational tier for Spot Bitcoin ETFs. 🛠 The Cornerstones of Approval: Addressing Past Concerns As howling winds presage a storm, the former SEC Chair’s proclamation signals the imminent dawn of a regulatory milestone. The narrative of a Spot Bitcoin ETF has been etched into the annals of regulatory deliberation, mired by concerns and cautious evaluations. Yet, as Clayton articulates, the time for decision stands behind us—the previous roadblocks to approval have been meticulously navigated and resolved. The unfolding of this saga bears testimony to the maturation of Bitcoin as a financial asset. The narrative now aligns with the burgeoning consensus among regulatory circles, which now perceptibly teeter on the brink of embracing Bitcoin. The watershed moment on the horizon—a Spot Bitcoin ETF’s sanctioning could unfurl a new chapter for traditional investors, granting them passage to Bitcoin through regulated avenues forthwith. 🔐 Advancements in Cryptocurrency Custodianship Such advancements culminate in securing the sanctuary for investors’ interest, effectively bridging the gap between the avant-garde of cryptocurrency and the stalwart walls of traditional finance. Indeed, a Spot Bitcoin ETF symbolizes a gargantuan leap in financial innovation, one entwined with the verve of Bitcoin and the stable bedrock of regulated frameworks. ⏱ A Countdown to Certainty: The Final Hours With Clayton’s emphatic declaration as a herald, the SEC now perches at the threshold of resolution. Bloomberg illumines the scene with anticipations of Spot Bitcoin ETF hopefuls resting on the tender mercies of an SEC nod by the close of the forthcoming Wednesday. The cogs of approval, once ground to a slow pace, now quicken with alacrity — if granted, these ETFs could emerge, phoenix-like, into the marketplace with immediate virtue. 🔮 A Glimpse into the Financial Frontier: The Impact of Approval The forthcoming sanction of a Spot Bitcoin ETF stands not only as an affirmation of Bitcoin’s stature but also sketches the silhouette of the future financial landscape. Traditional investment reservoirs, once pooled away from the currents of Bitcoin, may soon merge with the surging tides of cryptocurrency investments. The profound implications for market dynamics, investor portfolios, and the crypto industry at large are immeasurable. ✨ Conclusion: Embracing the Inevitability of Progress In summary, Jay Clayton’s words resonate as a clarion call heralding the imminent evolution of Bitcoin from a digitalized outlier to a cornerstone of fiscal legitimacy. Through the prism of regulatory acceptance and enhanced market trust, the inevitability of a Spot Bitcoin ETF’s approval flags not merely a waypoint but a landmark in the financial continuum. This beacon of innovation signifies an embrace of Bitcoin’s potential to revolutionize and enrich our financial futures.Are you poised to be part of this transformative surge? Join me in traversing this unprecedented threshold – Together, let us unlock the gateways of innovation and herald a new epoch in finance. Connect with this odyssey of progress through LinkedIn, and let the shared vision of a Bitcoin-bolstered future take flight. 🚀🌟

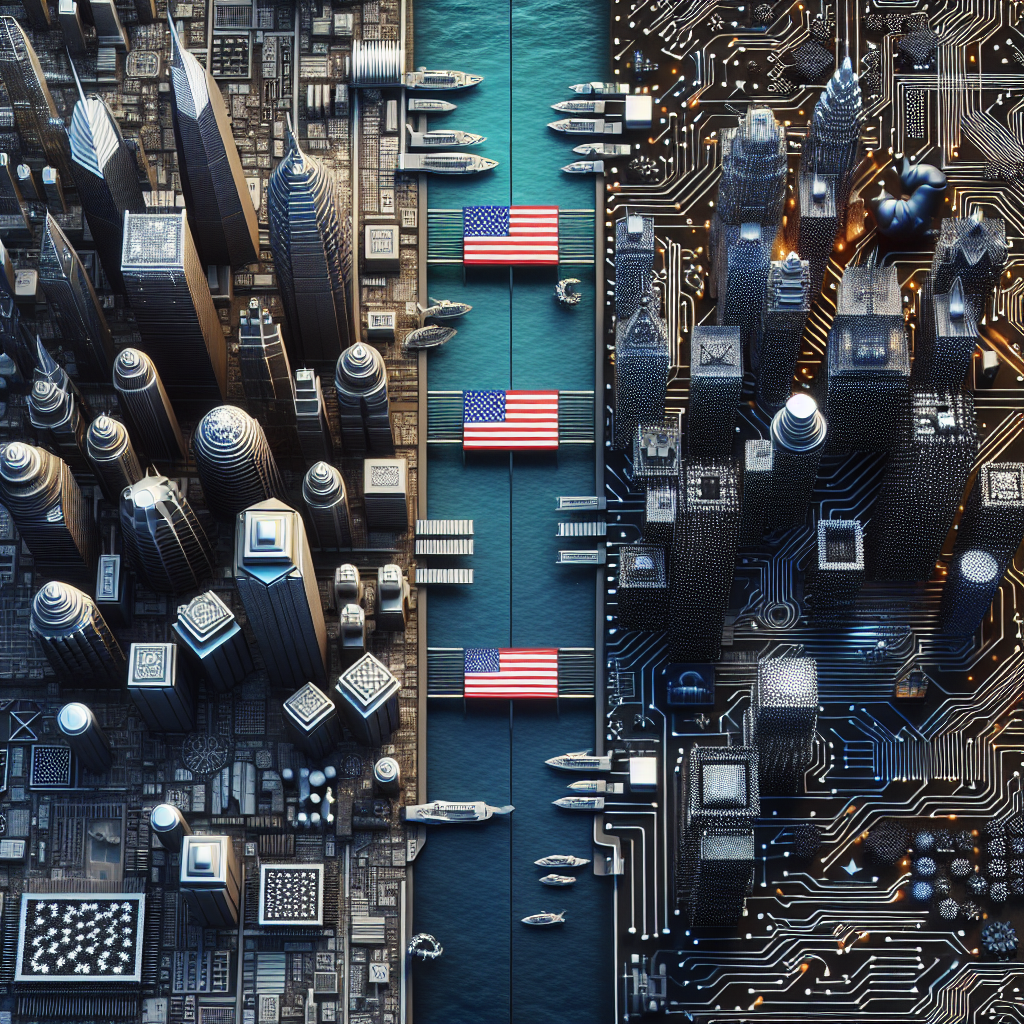

Navigating the Tides of Techno-politics: The Sino-American Quest for Innovation Supremacy

Navigating the complex waters of international politics is a formidable challenge for any global entity, particularly when it involves the two world superpowers: the United States and China. Amid escalating tensions, companies find themselves at the intersection of innovation and statecraft. Operating at the bleeding edge of technology while stationed in Beijing, businesses come under intense scrutiny, their research labs turning into arenas of geopolitical contention. This article delves into the implications of these circumstances, offering a compelling analysis of the risks and opportunities that lie at the forefront of Sino-American relations. Stepping Into the Geopolitical Fray: The Genesis of Global Tech Laboratories Embarking on a venture in an overseas territory, especially in a city like Beijing—where the lines between technology and state directives are often blurred—is akin to a high-stakes game of chess. Such strategic positioning allows companies to tap into a vast pool of talent, incentivize innovation, and stay ahead in the competitive race; however, it equally subjects them to the magnifying lens of international politics. The Power Play: Balancing Innovation with Diplomatic Acumen Companies at the cutting-edge of technology must tread a fine line between pursuing progressive innovations and respecting the shifting sands of diplomatic relations. They serve as inadvertent pawns in the larger geopolitical game, their advances potentially reshaping the competitive dynamic between these two global titans. It’s a balancing act of maintaining corporate interests while navigating the strategic expectations of host and home countries. Red Flags and Alarm Bells: The Security Dilemma The operation of advanced research labs in politically-sensitive regions raises red flags for national security concerns. Intellectual property, trade secrets, and advancements in critical technology sectors become focal points for scrutiny, with concerns over espionage and technological theft ever-present. Here lies the security dilemma: how to safeguard national interests while still promoting a globalized landscape of research and innovation. The Toolbox of Diplomacy: Risk Mitigation Strategies To mitigate these risks, companies require a sophisticated toolset that blends innovation with diplomacy. This may entail implementing stringent security measures to protect intellectual property, fostering transparent communication with government entities, and perhaps even diversifying research locations to temper geopolitical vulnerabilities. The Olive Branch: Potential Pathways to Harmonious Operations Despite the challenges, potential pathways exist for harmonious operations. Establishing mutually beneficial partnerships with local institutions, investing in community development, and adhering to a nuanced understanding of the socio-political environment can serve to defuse tensions. Conclusion: Charting the Uncharted – The Odyssey of Innovation Amidst Geopolitical Waves In conclusion, the narrative of companies operating advanced research labs in Beijing amidst U.S.-China tensions is an odyssey of innovation, ambition, and strategic vision. As they chart these uncharted geopolitical waters, their journey is emblematic of the intricate dance between technological progress and the imperatives of national security. It’s a tale that continues to evolve, and one which holds profound implications for the future direction of global innovation and international relations.Are you ready to join the movement and redefine the scope of what’s possible within your organization? Connect with me on [LinkedIn](https://www.linkedin.com/in/laurentrochetta/) to explore how you can harness the power of cutting-edge technology and embark on a journey of unparalleled innovation. 🚀🌟

The Electric Shift: How Depreciation and Costs are Steering a Rental Car Giant’s Fleet Strategy

In a pioneering yet challenging move, a prominent rental car company has faced a stark reality: the swift devaluation of electric vehicles (EVs) accompanied by surging repair costs, compelling the firm to liquidate a significant portion of its fleet—20,000 cars, to be precise. This seismic shift in asset management pinpoints the volatile nature of the automotive industry, which has been reshaped by the electric revolution. A Jolt from Market Dynamics: The Devaluation Dilemma The allure of sustainable transportation has led to an initial surge in EV adoption, yet rental companies must navigate the financial repercussions of a market where innovation outpaces EV longevity in terms of value retention. With technology advancing at breakneck speed, today’s cutting-edge models swiftly become tomorrow’s relics, accelerating depreciation and transforming fleet economics. Repair Costs Escalating: An Unforeseen Burden Beyond the depreciation conundrum lies another formidable challenge for the rental behemoth: the exorbitant costs of maintaining and repairing these sophisticated vehicles. EVs, with their intricate electronic systems and specialized components, pose a higher financial barrier for upkeep compared to their internal combustion counterparts. It’s not merely the scarcity of replacement parts or the need for specially trained technicians—EVs also present inherent design complexities that amplify repair expenses. The Ripple Effect: Assessing Industry Impact The ramifications of such a strategic pivot extend beyond individual corporations and ripple through the entire automotive industry. This mass offloading of electric vehicles could not only influence the resale market but also send ripples across production decisions for automakers. Manufacturers and their supply chains are closely monitoring these trends, understanding that the rental sector’s procurement patterns significantly shape demand forecasts. Navigating the New Terrain: Innovation and Adaptation In response to these challenges, innovation becomes the harbinger of adaptation and survival. Embracing advancements in battery technology, modular designs, and predictive analytics could provide a pathway for rental companies to mitigate depreciation risks and maintain efficient operational costs. Establishing partnerships with manufacturers and investing in research and development may lead to a more sustainable and profitable fleet composition. The Strategic Shift: A New Fleet Philosophy Adapting to the changing economic landscape, the rental company’s approach has shifted towards an acute assessment of vehicle lifecycles and an agile response plan. By incorporating data analytics and market forecasting, the company can make informed decisions on fleet renewal cycles and establish a balance between embracing innovation and preserving asset value. In Conclusion: The Road Ahead for Rental Car Enterprises The journey of car rental companies navigating the complex terrain of the EV market highlights the delicate interplay between advancement and asset management. By coupling innovative approaches with strategic planning, businesses can steer through the challenges towards a future where electric vehicles constitute a sustainable and profitable segment of a dynamic fleet. As they zoom towards such a horizon, the stakes are high, but so are the opportunities for transformative success in the shifting sands of the automotive world.Are you ready to join the movement and redefine the scope of what’s possible within your organization? Connect with me on [LinkedIn] to explore how you can harness the power of innovation and embark on a journey of unparalleled adaptability and success. 🚀🌟

Exchange-Traded Funds: Revolutionizing The Crypto Landscape

Imagine living in a world where crypto-financial instruments are much more than mere speculative assets; they are a gateway to mainstream financial markets. We are entering such an epochal shift with federal regulators green-lighting exchange-traded funds (ETFs), setting the stage for a watershed moment in the cryptocurrency domain. Such a historic move not only catapults digital currencies into the echelons of traditional investments but also unlocks innovative pathways for investor engagement. Are these ETF products poised to become the cornerstone of crypto revenue streams? How can this pivotal development shape the future of individual and institutional investments? This blog post dives into the intricacies of this revolution and sketches an inspirational trajectory for crypto aficionados and professionals alike. The Initial Struggles: Navigating Uncharted Financial Waters Starting a venture in the highly volatile world of cryptocurrencies is akin to setting sail in turbulent seas. The initial phase is fraught with challenges, from regulatory scrutiny to market skepticisms. Entrepreneurs and investors tread a path marred by unpredictability and rapid changes that can bring even the mightiest to their knees. Yet, it is within these tumultuous beginnings that the foundations of perseverance and adaptability are laid. In the face of such obstacles, learning becomes the beacon that guides one through the fog of uncertainty. Each setback, each regulatory hurdle, and each market fluctuation presents itself as an opportunity to strengthen resolve and refine strategies. The birth of crypto ETFs is a testament to the industry’s resilience and its relentless pursuit of recognition and stability within the broader financial ecosystem. The Turning Point: The ETF Endorsement and Its Implications The approval of crypto ETFs represents a significant turn in the tides. It heralds a new era where cryptocurrency begins to shed its speculative skin and don the garb of validated financial products. This momentous event could be analogized to a breakthrough innovation or a seal of approval from the highest financial authorities. The significance of such sanctioning opens a plethora of avenues for crypto businesses, offering a credible alternative to traditional investment vehicles, thus attracting a new wave of investor demographics. This federal endorsement is not just a nod of approval but a launching pad for broader acceptance. It demystifies the crypto world for the average investor and establishes a bridge between the new-age digital asset class and the time-honored investment strategies of Wall Street. Such integration into mainstream financial markets can potentially trigger a cascade of capital influx, aspiring to bring about stability and growth in what was once considered an elusive and volatile market. Scaling Up: Embracing Growth in the Crypto ETF Frontier Post the tidal shift of recognition, the next logical progression is scaling the business to meet the burgeoning demand. Strategies here pivot on a multitude of axes – diversifying product offerings, enhancing liquidity through market-making practices, and advocating for robust regulatory frameworks that sustain growth yet deter market manipulation. The potential for fortunes in the crypto ETF space is vast, but it needs a nuanced approach towards managing the assets underlying such products. The sensitivities around crypto valuations require a firm grip on market dynamics and an agile approach to risk management. Success stories in this realm will revolve around businesses that not only innovate but also instill investor confidence through transparency and compliance adherence. Lessons Learned: Essential Insights from the Crypto ETF Milestone The journey till now has yielded invaluable lessons – foremost being the power of persistence. Crypto market participants have learned the importance of regulatory engagement and collaboration. The ETF endorsement demonstrates the significant role of building bridges with regulators and the need to articulate the value proposition of cryptocurrencies pragmatically. But the lessons extend beyond regulatory diplomacy; they underscore the need for a customer-focused approach that aligns product innovation with investor protection. The market has also learned to foresee the pitfalls of hype-driven momentum and instead focus on building sustainable and scalable business models that can withstand the ebb and flow of investor sentiments. The Future: Charting The Course of Crypto ETFs Looking beyond the current celebratory milestones, the future for crypto ETFs is luminous with boundless potential. The future envisages an expansion in ETF varieties, including those based on futures, multiple cryptocurrencies, and even thematic crypto investments. Strategy and technology will intertwine to create novel investment paradigms, catering to the risk appetites and interests of a diverse investor base. The horizon gleams with the promise of integrating these products with other financial services, thus deepening the relationship between cryptocurrencies and conventional financial markets. The ultimate vision is to establish crypto ETFs not as outlier investment options but as an integral player in the portfolio of both retail and institutional investors. Conclusion: The Transformative Influence of Crypto ETFs In conclusion, the journey of crypto ETFs from a conceptual novelty to a recognized financial instrument is one of transformative power. It is a narrative replete with resilience, grit, and visionary preempting that heralds the era of crypto entering a new phase of maturity and stability. Crypto ETFs stand as a beacon for aspiring entrepreneurs and investors, demonstrating that with the right blend of innovation, tenacity, and strategy, even the most disruptive technologies can find a place within the canon of traditional financial systems.Are you ready to join the movement and redefine the scope of what’s possible within your organization? Connect with me on [LinkedIn](https://www.linkedin.com/in/laurentrochetta/) to explore how you can harness the potential of crypto ETFs and embark on a journey of financial innovation and growth. 🚀🌟

The Winds of Change: Doug Timmerman Takes the Helm at Ally Financial

Imagine living in a world where the financial industry is more than a mere enabler of transactions; it is a consistent source of innovation and is a beacon for those aspiring to make impactful decisions. The world has been observing such dynamism, with financial businesses and tools redefining markets and offering advanced solutions to intricate challenges. As Doug Timmerman prepares to take charge as the interim CEO of Ally Financial, embracing the legacy of Jeffrey Brown, this blog post delves into the significance of such leadership transitions and offers an inspiring foresight for financial connoisseurs and industry enthusiasts. 🔍 The Genesis of Leadership: Ally Financial’s Strategic Mastery With the baton of leadership handed over, Doug Timmerman must navigate the robust legacy of Ally Financial, a company synonymous with resilience throughout economic cycles. As a beacon of trust with a track record of innovative financial solutions, the journey of Ally Financial under Timmerman’s supervision heralds the promise of continuity flavoured with the zest for transformation. In this section, we recognize the firm’s foundational values set by its previous stewards and how Timmerman’s innate understanding of these precepts positions him uniquely to drive growth and inspire confidence among stakeholders and clients alike. 🌟 The Epoch of Expansion: Propelling the Company Forward Transitioning into the role of an interim CEO, the challenge for Doug Timmerman lies in not just filling shoes but in expanding the institution’s footprint. His strategic acumen, cultivated through years of intimate involvement with the company’s multifaceted operations, will be key in steering Ally Financial into an era of unprecedented growth. This section delves into the tactical shifts Timmerman might employ, emphasizing expansion strategies that align with the company’s rich history while targeting novel markets and leveraging cutting-edge technology. 💡 Ingenuity at the Forefront: Innovating Financial Services Innovation has always been Ally Financial’s strong suit, with a plethora of customer-centric solutions proving its market leadership. As Timmerman ascends, the focus sharpens on sustaining that innovative spark and nurturing it to create financial services that resonate with the evolving needs of the current times. This segment discusses the potential for Doug Timmerman to catalyze a new wave of innovation, reimagining consumer finance and ensuring that Ally Financial stays at the vanguard of the financial revolution. 📊 The Data-Driven Decisions: Analytics as the New Currency In the digital age, data is paramount, and the decisions derived from its analysis are transformative. Timmerman’s tenure is poised to enhance the company’s data-driven culture, infusing analytics into every strategic decision, thereby shaping a future where Ally Financial thrives on insights and foresight. Here, we’ll unravel the significance of data analytics in today’s financial landscape and how Timmerman’s leadership could magnify Ally Financial’s prowess in making informed, evidence-based decisions. 🌐 Embracing Global Horizons: Ally Financial’s International Outlook The ambit of financial services is not limited to local spheres; it’s about global connections and international prowess. For Ally Financial, under Timmerman’s tutelage, the opportunity lies in going beyond the confines of domestic markets to embrace a more holistic, international outlook. Analyzing the potential pathways to globalize services, this section underscores the international opportunities awaiting Timmerman’s strategic orientation to cultivate a diverse, inclusive, and global Ally Financial. Conclusion With the appointment of Doug Timmerman as the interim CEO, Ally Financial embarks on a fresh chapter where the tenets of agility, strategic insight, and visionary foresight coalesce. This transition doesn’t just signify a change of leadership; it heralds a renewed commitment to upholding the company’s distinguished heritage while steering it towards a prosperous and inclusive future.Are you ready to join the movement and redefine the scope of what’s possible within your organization? Connect with me on [LinkedIn](https://www.linkedin.com/in/laurentrochetta/) to explore how you can harness the power of strategic financial leadership and embark on a journey of unparalleled productivity. 🚀🌟

The Importance of Time Management

Time management is a crucial skill for achieving success in both personal and professional life. It involves planning and organizing how time is allocated to specific activities to effectively achieve goals. Benefits of Time Management – Increased productivity and efficiency – Reduced stress and anxiety – Improved quality of work – More free time for relaxation and leisure activities Time Management Techniques – Prioritizing tasks based on importance and urgency – Setting SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) – Using time management tools and apps – Eliminating time-wasting activities Conclusion In conclusion, time management is an essential skill that can lead to greater productivity, reduced stress, and overall improvement in the quality of life. By implementing effective time management techniques, individuals can achieve their goals more efficiently and create a better work-life balance.Learn more about time management and start implementing these techniques today for a more organized and successful life.

The Pursuit of Reversing Aging: Unveiling the Secrets of Longevity

Imagine living in a world where the quest for the fountain of youth is much more than a legend; it’s a constant source of scientific inquiry. The world is already witnessing such a quest, with biotech companies and medical researchers controlling the realms of health and well-being, and offering innovative solutions to the enigma of aging. So, the question here is, can these advancements serve as a persistent source of rejuvenation? Can an individual truly tap into the secrets of longevity that generate a life not just extended in years, but enriched in vitality? This blog post uncovers these captivating questions and offers an inspiring look into the future for those seeking to outpace the ticking clock of life. The Elusive Elixir: Debunking Historical Anti-Aging Myths (Content Hidden) The DNA of Aging: Deciphering Biological Timelines (Content Hidden) Peptides and Proteins: The Building Blocks of Youth (Content Hidden) Regenerative Medicine: Blurring the Lines Between Healing and Aging (Content Hidden) Antioxidants: Disarming the Free Radicals of Aging (Content Hidden) Conclusion: The Age of ‘Aging Gracefully’ Reimagined (Content Hidden)Are you ready to join the movement and redefine the scope of what’s possible within your organization? Connect with me on [LinkedIn] to explore the exceptional possibilities of emerging technologies and how they can be applied to not just extend life, but to enhance its quality.